First Tech Federal Credit Union is a nationwide credit union that offers student loan refinancing.

Student loan refinancing can help you tap into a lower interest rate or lower monthly payment to fit your budget better. Refinancing can even help you consolidate your student loans into a single monthly payment.

If you’re looking to consolidate your loans or lower your payments, you may consider First Tech Federal Credit Union.This First Tech Federal Credit Union review gives you a closer look at this credit union to help you determine if it’s a right fit for your needs.

First Tech Federal Credit Union Details | |

|---|---|

Product Name | First Tech Student Loan Refinancing |

Min Loan Amount | $5,000 |

Max Loan Amount | $500,000 |

Fixed APR | 8.60% and up |

Loan Terms | 5 to 15 years |

Promotions | None |

What Is First Tech Student Loan Refinancing?

First Tech Credit Union was originally founded in 1952. Since its founding, the credit union has opened its membership to businesses and individuals in the technology industry.

A few organizations that have partnered with First Tech include Hewlett Packard Enterprise, Microsoft, Intel, Amazon, Intuit, and Google, to name a few. As an employee in the technology industry, you’ll likely qualify for membership in this credit union.

Based on asset size, First Tech is a top 10 credit union in the U.S. With over 500,000 members, many have decided to use First Tech’s products for their money management solutions.

What Does It Offer?

First Tech Credit Union offers a suite of financial products like checking accounts, savings accounts, retirement accounts, and more. But today, we are diving into what the credit union has to offer borrowers seeking a student loan refinancing option.

Here’s what stands out about First Tech’s student loan refinancing opportunities.

Unique Loan Options

When it comes to student loan refinance, the most common offering is a fixed-rate loan with a set term. In this case, you would sign up for a monthly payment for an extended period of time. The monthly payment won’t change with this option.

In addition to the fixed-term option, First Tech offers balloon loans and interest-only loan options.

Here’s a closer look at those unique options:

Balloon Loan: Through the First Tech balloon loan, you can choose a balloon payment for either 40% or 50% of the total loan amount. With that, you would make a monthly payment for a predetermined loan term. At the end of the loan term, you’d be required to make a large lump sum payment to pay off the remaining balance.

Interest-Only Loan: The interest-only loan offers lower monthly payments upfront. But after the initial interest-only period, you’ll start making fixed principal payments on top of your interest payments.

The idea with either of these options is that your income will grow to match the payments. However, it can be a big risk for your budget to sign up for these unusual loan types, especially if you’re unsure what your income may look like when the term is up and you have to make that lump sum payment. Weigh out your options carefully before jumping into a loan with growing payments.

Attractive Interest Rates

When considering a refinance of any kind, the interest rates are a critical piece of the puzzle. The goal of a refinance is to lock in an interest rate lower than what you currently pay.

As of August 2024, First Tech is offering student loans with a fixed APR as low as 8.60%. For borrowers with loans taken out in the last year, this could be a lower rate than they currently have attached to their student loans.

If you want to find out the interest rate for a 5-year term, you can easily check your rate with First Tech. It’s a soft credit inquiry, so your credit score shouldn’t be impacted in any way.

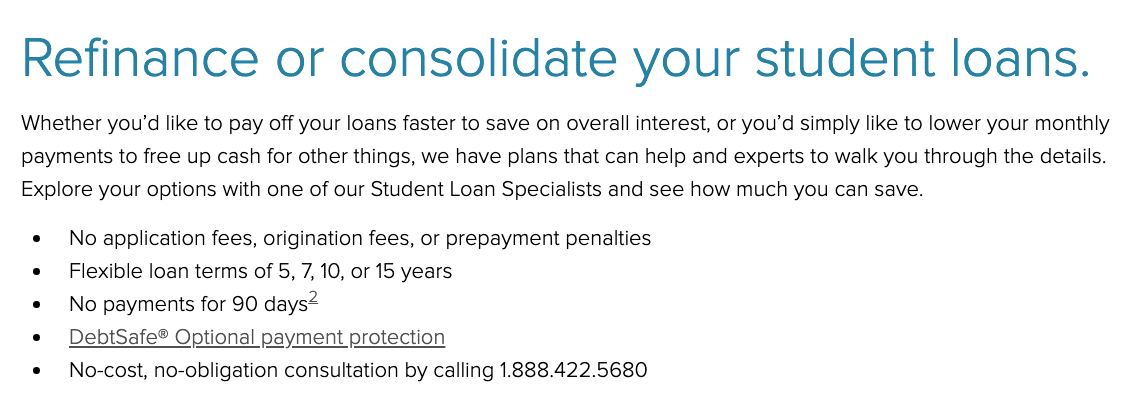

Flexible Loan Terms

When refinancing, many have the goal of lowering their monthly payment. The interest rate is one important factor that affects your monthly payment. But another critical factor is the loan term.

A longer loan term allows you to stretch out the principal balance and leads to a lower monthly payment. With First Tech, you can opt for a loan term of five, seven, 10, or 15 years. The wide range of term choices gives you more control over your monthly payment amount.

DebtSafe Loan Payment Protection Option

Do you have a plan for making your student loan payments in the event of disability or involuntary unemployment? If not, then the optional DebtSafe loan payment protection could be a useful add-on to your loan product.

Essentially, this protection could cancel your loan balance or eliminate payments if a covered event happens. This can provide you and your family with some peace of mind.

Limitations

Although First Tech’s refinancing offers some positives, there are also limitations to consider.

If you return to school while paying back this loan, the credit union won’t allow you to defer your payments.

Additionally, students cannot refinance PLUS loans into the student name. Instead, PLUS refinancing is only an option for the original primary signer. So, if you want to refinance loans out of your parent’s name, that’s not an option through First Tech.

Are There Any Fees?

According to First Tech, there are no application, origination, or prepayment penalties. However, you’ll be stuck paying the APR attached to your loan balance.

When considering a student loan refinance, it’s important to shop around before moving forward. Otherwise, you might end up paying more than you need to in interest charges.

Fixed-Rate Loans | Balloon Loans | Interest-Only Loans | |

|---|---|---|---|

APR | As low as 8.60% | As low as 11.40% | As low as 11.40% |

Benefits | Pay off your current student loan faster or consolidate multiple loans with one monthly payment. | A flexible option for working professionals just starting out. Get a lower payment now and have one larger payment later when you expect to have more income. | Allows you to make lower, interest-only payments at first, with a repayment schedule that grows with your income. You can pay down principle at any time with no penalty. |

How Do I Contact First Tech?

If you want to contact First Tech about their student loan offerings, you can make a virtual or in-person appointment through their website, send a secure message through your account, fill out a contact form, or call 888-422-5680.

You can also reach out via Facebook, Twitter, and Instagram @FirstTechFed. Or through LinkedIn @first-tech-federal-credit-union.

Since First Tech has earned 4.5 out of 5 stars on Trustpilot, you should expect a good customer service experience.

How Does First Tech Student Loan Refinancing Compare?

First Tech Federal Credit Union isn’t the only option for student loan refinancing.

A big limitation of First Tech is the lack of any forbearance or deferment options. So, if you encounter an unexpected hardship or head back to school, there’s no relief from this payment unless you’ve purchased the optional DebtSafe add-on.

Here’s what to understand if you are concerned about being unemployed and dealing with student debt. If you want to refinance a Parent PLUS loan into the child’s name, then consider ELFI (Education Loan Refinance).

Header |  | ||

|---|---|---|---|

Rating | |||

Variable APR | N/A | 5.28% - 9.99% | 5.28% - 8.99% |

Fixed APR | Starting At 8.60% | 4.89% - 9.99% | 4.84% - 8.69% |

Bonus Offer | None | Up to $500 | Up to $1,100 |

Cell |

How Do I Open An Account?

The first step of refinancing through First Tech is to become a member.

You can qualify for membership if you meet any of the following criteria:

- Someone in your family or household is a First Tech member.

- You or a family member works for the State of Oregon or a company on the partner list.

- You live or work in Lane County, OR.

- You belong to the Financial Fitness Association or the Computer History Museum.

If you meet the membership criteria, be prepared to provide the following information in the application process:

- Social Security Number

- Valid email address

- Home address

- Employer information

- Driver’s license

- Funding account information

Once you are a member, you can proceed with your student loan refinancing application. Be prepared to submit:

- Proof of income, like a W-2.

- Recent loan statements on your student loans.

The application should only take 15 minutes. If approved, you’ll find out within a few business days.

Is It Safe And Secure?

The National Credit Union Administration federally insures First Technology Federal Credit Union. With that, any funds stored in deposit accounts are protected for up to $250,000. Beyond that, the credit union monitors transactions to prevent fraud.

Is It Worth It?

If you qualify for membership with First Tech, then the student loan refinancing options are worth looking into. The attractive rates are an enticing option for most borrowers. But be wary of signing up for a balloon loan or interest-only option. Although we all hope our income will rise to pay for the increasing loan costs, locking in a low fixed rate is also a good option.

Before refinancing any federal student loans, make sure that you are comfortable giving up the federal borrower protections.

Not sure if First Tech is the right for your student loan refinancing needs?

Take a look at the best options to refinance your student loans.

First Tech Student Loan Refinancing Features

Min Loan Amounts |

|

Max Loan Amounts | All loans: $500,000 |

Rate Types |

|

APR | 8.60% and up |

Autopay Discount | No |

Loan Terms | 5, 7, 10, or 15 years to repay the loan |

Origination Fees | None |

Prepayment Penalty | None |

Late Payment Fee | Unclear |

Social Media Customer Service |

|

Customer Service Phone Number | Yes |

Customer Service Hours | 24 hours |

Customer Service Email Address | 888-422-5680 |

Address For Sending Payments | PO Box 4317 |

Promotions | None |

First Tech Federal Credit Union Review

-

Interest Rates

-

Cosigner Release

-

Loan Terms

-

Repayment Length

Overall

Summary

If you’re looking to refinance your loans or lower your payments, you may consider First Tech Federal Credit Union.

Pros

- Fixed-rate student loan refinancing options

- Multiple loan and payment options

- No application fees or origination fees

Cons

- No variable rate options

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Robert Farrington